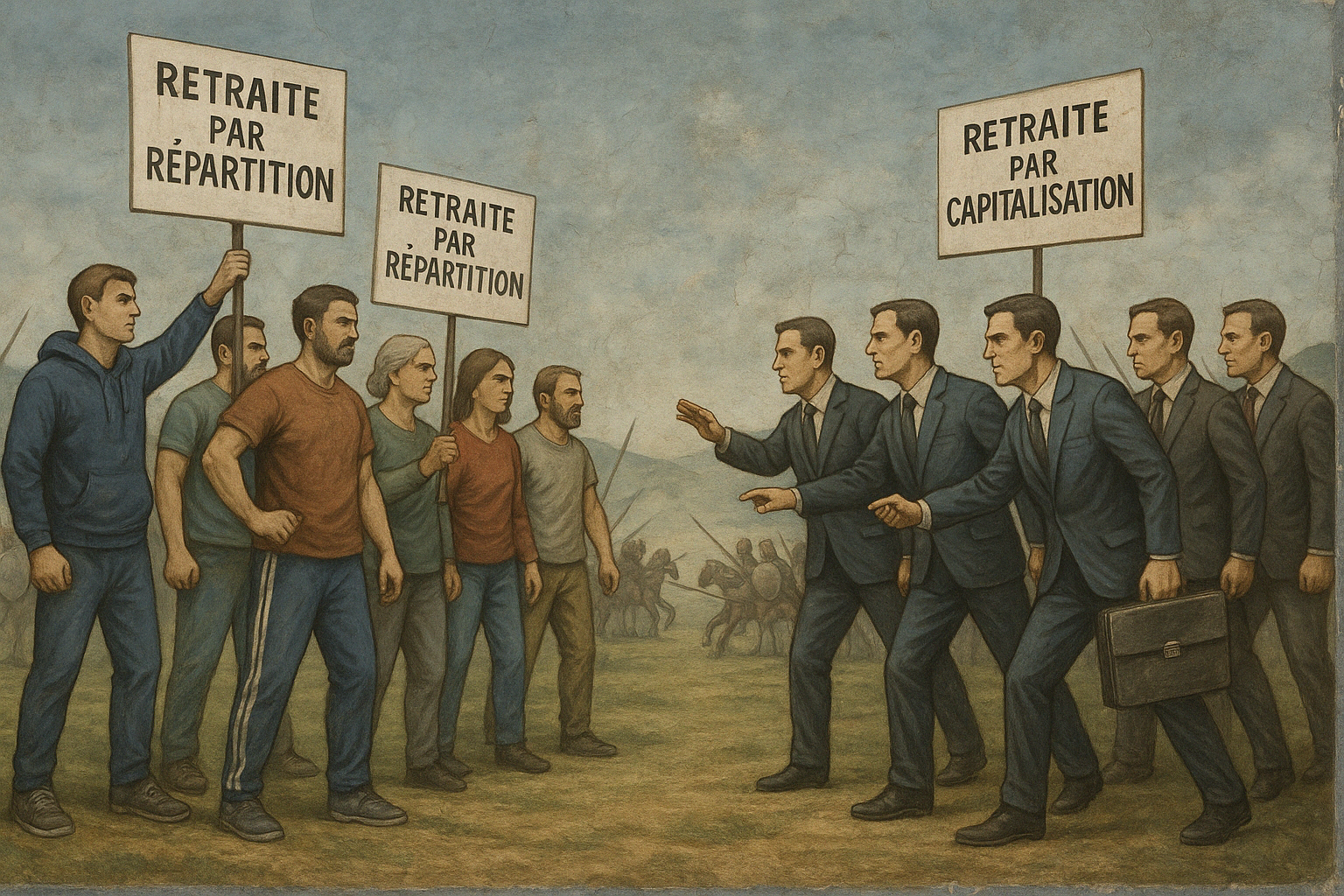

Reflection on the economy: Funded or pay-as-you-go pension system Translated with ChatGPT

Resume

Summary:

A debunking of preconceived ideas about the two main different types of possible pension schemes (pay-as-you-go or funded) and a presentation of the advantages and disadvantages. Followed by my personal opinion on the subject.

Introduction

Go figure why, every time the stock market hiccups, debates on funded pensions resurface on social media. Here is a post whose comments contain almost all the most common positions on the subject:poste panettonepazzo bsky

And, as I disagree with all his positions, I told myself that I would, in turn, give my opinion.

First, some definitions

But first of all, so that we know what we are talking about, I will briefly define what a pay-as-you-go pension and a funded pension are.

Pay-as-you-go pension

The pay-as-you-go pension system is the scheme of most pension funds in France and around the world. It involves, each year, deducting a contribution/tax from the salary of active workers to fund the payment of that year's pensions. In fact, in this system, the pension is funded like any other state service or social aid.

In this system, contrary to a widespread belief, one does not pay for their own retirement, but for the retirement of current retirees. (and especially of his parents). It is as erroneous to say that one pays contributions for one's retirement as it is to say that one pays taxes to reimburse one's education.Contrary to what is often heard, contributions are not salary.Deferred but socializedIt is not the salary you will receive in the future, but an expense that is shared among all employees.

Instead of the employer paying you a salary and each person using their salary to support their parents, children, and pay for their care, the salary is put into a common fund that will provide pensions to those with parents, benefits to those with children, and reimbursements for care to those who are ill. This means that we pool together to pay for certain mandatory expenses instead of paying them individually.Nearby, one can also abandon their parents to misery, but it seems that it is not moral.)

With this system, single wealthy orphans without illnesses lose. On the other hand, people with large families, illnesses, and limited means win (and overall we all win by having the guarantee that the elderly, children, and the sick will not fall into begging or crime).

And it's a bit the same.Same principle for taxes used to finance public services.

When you were a child, your parents and their single friend who hates children paid taxes so that you would be locked up all day in a school so they could go party without having to take care of you (children, don't believe those who tell you that people work in companies or that Santa Claus doesn't exist, they are all liars or worse, unionists).

And, to thank them for their generosity, you will not fail to pay retirement contributions so that a money-hungry company hires underpaid immigrants forced to keep quiet under threat of being deported from the country, forcing them to stay all day in an air-conditioned room at -15°C watching TV with other elderly people who have become senile after their 50th hour of BFM TV in the week.

Funded pension

Funded retirement, on the other hand, is a scheme present in all countries worldwide in a minority way (including in France). It involves financing retirees through the savings they have accumulated during the years they were active.

Unlike the previous one, in this system, our contributions are used to fund our own retirement and not that of others. However, since the vast majority of French employees do not contribute to a fund managed by capitalization, it remains false to say so.(for now).

More specifically, this means that each month the employee will pay mandatory or optional contributions that will be transferred into a fund responsible for making them grow by purchasing financial products (generally stocks, but one can imagine funds that only buy bonds or gold). About ten years before the legal retirement age, the fund begins toGradually sell the accumulated assets at the rate of one one-hundred-twentieth per month. On the day of retirement, the money thus obtained will be entrusted to an insurer who, in exchange for this capital, will commit to paying a monthly annuity to the employee until the end of their life.

You may ask me why not give this sum directly to the employee so they can spend it? For the same reason that one takes out home insurance instead of setting aside money to buy a new house in case theirs is destroyed: because it is much more efficient to use the law of large numbers to pool the risk.

This barbaric expression means that while it is impossible to know individually if a risk will occur, on a large scale of people it is perfectly predictable.

For example, it is impossible to know if your house will catch fire or at what age you will die, but at the societal level, we know that on average one in 10 houses will catch fire and that on average people will die at 87 years old (figure invented for the example).

So instead of each person setting aside enough to repair their house after a fire or pay for retirement until the age of 150 (one must be optimistic in life), we collectively set aside enough to repair a tenth of everyone's houses and pay for everyone's retirement until the age of 87.

It allows everyone to benefit from optimal security for a fraction of the cost it would have incurred.

Let's debunk a false idea: both systems are perfectly on track

We are inundated with alarmist discourse telling us that the pay-as-you-go pension system will collapse, that it is a Ponzi scheme.

And the same people then tell us that the financial system is going to collapse, that our savings will be worthless, that our real estate will be confiscated to pay the debt, and therefore that funded retirement is hardly any better.

The only solution would seem to be having kids so they take care of you when you are too old, but when it's time to ride mammounYou remember that with the crisis, climate change, and the apocalyptic bedbug epidemic, he will probably be unemployed or too busy hunting mammoths in the ruins of civilization to take care of you, depending on you for food.

However, if you have read the previous paragraph carefully, you will not need me to understand that the pay-as-you-go system is nothing like a Ponzi scheme and has no reason to collapse.

Or rather, causing the pension system to collapse amounts to causing the state to collapse. Or more realistically, to a voluntary decision by those who manage the state.

And that is the true weakness of this regime, which explains why, as surprising as it may seem today, in the 1920s/30s, the CGT and left-wing parties were against the establishment of a general retirement system (they wantedcontinue with funds managed locally by the unions): A pay-as-you-go system involves giving too much power to a centralized state run by people who do not truly have the workers' interests at heart. However, if they do not have the employees' interests at heart, this does not seem to be the case for the elderly, as right-wing politicians are so dependent on their vote to get elected andYou are a professional translator. Directly translate this text into English, without adding anything.They are increasing every year due to the aging of the population.

I think it is therefore unlikely that pensions will ever be radically challenged by politicians, even the most liberal ones. Note that improbable does not mean impossible, but the risk seems to me to be of the same nature as that weighing on funded pensions.

Indeed, you will have understood from my brief explanation that if they are well managed, even a crisis as significant as that of 29 will not call into question a pension system based on capitalization.

Indeed, even the crisis of '29 is anecdotal over 40 years and does not have a significant impact on the final valuation of the employee's capital. And, if the sale of financial products was indeed spread over ten to twenty years, this crash should not have much impact either.

Indeed, over a long period (at least 20 years), the return on stocks (i.e., a diversified index like the MSCI World) is equal to global growth (3% per year on average according tola banque mondiale during the last 40 years) + inflation (maintained at 2% per year on average by central banks). This gives a long-term return of 5% per year that is difficult to beat.

Finally, that's for the past, you might say, and as the adage goes, whose omnipresence tends to make me nauseous: past performance does not guarantee future performance. However, this long-term performance seems to meBe linked to structural causes that I can hardly see being challenged in the next 30 years.

Indeed, I do not see how it would be possible for listed companies to stop seizing the majority of growth and redistributing it to their shareholders if we remain in a capitalist society. And apart from a few extremely minority far-left groups, no one questions capitalism.

Regarding growth, in the coming years, the world population will continue to increase and a large majority still does not have access to a minimum comfort and does not aspire ...than to get rich. And apart from a world war, I don't see what could prevent it from achieving its goals. I therefore think that until 2050, global growth will continue to be strong.

On the other hand, after 2050, I have no idea if we will still have the capacity to grow and cope with the effects of climate change, biodiversity loss, soil eutrophication, and other environmental factors. Moreover, I would like to clarify that not only is La France Insoumise not an extreme left party and poses no threat to the capitalist system, but I also believe, like many economists, that if its program were applied globally, it would boost global growth in the long term. Indeed, in the short term, the current policy of reducing research funding (even prohibiting some for ideological reasons), under-investing in infrastructure, destroying soil fertility, and poisoning water causes a boost ofShort-term growth at the expense of destroying the foundations of future growth. And I'm not even talking about the effects of declining trust in the authorities created by their repeated lies or widespread corruption. But on that point, I fear that the leaders of France Insoumise are no better than the Macronists.

But, this is just my opinion and it is certainly not advice to invest all your money in a world ETF. I remind you that I cannot see the future and am therefore unable to guarantee a positive return for any investment, regardless of the duration (yes, this is a somewhat hypocritical phrase to absolve myself of any responsibility if one of my readers invests in the stock market after reading this article). But let's get back to the subject.

You are a professional translator. Directly translate this text into English, without adding anything.the real weakness of the systemretirementThe capitalisation does not lie in the capitalisation phase and its dependence on stock market indices, but in the annuity phase and its dependence on state debt.

Indeed, insurance companies, in order to guarantee retirees that they will continue to receive their pensions, are obliged to invest the money entrusted to them in the safest securities, that is, in government bonds. Therefore, if there were a significant crisis that forced the state to default on its debt, then insurers and thus the capitalization-based pension system would collapse.

In conclusion, the only thing that could cause a pay-as-you-go system to collapse is also the only thing that could cause a funded system to collapse: a major state debt crisis or a youth revolution that no longer wants to pay for the elderly. Both systems are therefore equally secure.

And even, if I will not argue it much as it seems to me a truism, I will add that in both cases, it is impossible for a 20-year-old to know what the amount of their pension will be and at what age they will be able to take it. When you want to be sure of your move, you don't make bets on the future, you cultivate your garden and live day by day.

Get to the point: what's the best system?

Preambles

Now that these misconceptions are debunked and we agree that both systems are just as viable as each other, it is time to ask which one is better.

For this, one must ask what a retirement system is and what it is used for. A retirement system is a system that gives inactive people the right to take a portion of the production from active people each year (bread, TVs, cars, healthcare services). Some might nitpick and say that retirees are not truly inactive and perform essential tasks for society despite their age, such as babysitting while parents work or managing the condominium association that maintains the building where the active people live. But to simplify, let's say that all retirees spend their days sitting on the couch watching TV, complaining that young people are lazy and no longer have a taste for hard work.

So a pension system is always: a rule that will concretely allow for calculating who must contribute, how much and how. And symmetrically, who will receive, how and how much. We will assess the relevance of this rule according to two criteria:

-

The moral arguments in its favor. Otherwise, the ideology that supports it.

-

Its concrete effects, in other words, its consequences if implemented

Funded pensions are right-wing and pay-as-you-go pensions are left-wing. Really?

If we simplify to the extreme in all countries of the world for two hundred years, political life is split into two groups: left and right in France, Republican and Democrat in the USA... Many of their characteristics vary depending on the place and time, but the main features remain constant (to my knowledge). Schematically, we can say that regardless of place and time, for the left: "everyone must contribute according to their means and receive according to their needs" while the right wants "everyone contributes according to their desire and receives according to their contribution."

In summary, the left wants the richer you are, the more you are obliged to contribute to the system in the form of tax/contribution/levy and to receive a pension allowing for a comfortable life, regardless of your contribution.

For the left, if you have never paid a cent in taxes but need 2,000 euros per month to live decently (for example, because you have an illness and are a tenant) in an ideal world, you should receive 2,000 euros per month from the community, while at the same time a person who has worked all their life and paid a lot of taxes but only needs 1,000 euros per month because they own their home and are in good health should only receive 1,000 euros.

Conversely, for the right, no one should be forced to contribute if they don't want to. However, in the end, their retirement will strictly depend on what they have contributed. If you have contributed a lot, you will receive a lot, and if you have contributed nothing, you will receive nothing, and too bad if you die of hunger. For them, the individual must be free in their decisions and therefore bear the consequences.

In fact, each side and even each individual has more nuanced positions. For example, most right-wing people admit that one cannot let someone starve, even if it's an irresponsible person who has never contributed. If only because they will not let themselves starve and become a thief. For everyone's safety, the right admits that people must be compelled to contribute a minimum, in order to guarantee a minimum of rights. And most left-wing people admit that those who contribute more should receive a little more. And there are minority ideologies on the left and right, not at all agreeing with what I just said. For example, anarcho-communists support the idea that everyone should contribute and receive according to their desire. For them, people should be allowed to contribute to the common pot as they see fit and help themselves as they wish from the common pot. Said like that, it seems totally utopian, but in fact, there is a real system behind it that is far from foolish, but that's not the subject of this note, so let's move on.

The subject is capitalization or redistribution. And at first glance, one might want to say that capitalization will satisfy right-wing people and redistribution left-wing people, because in a capitalization system everyone makes their own savings and has a pension that depends on the amount of these savings (one is free to contribute and receives according to what they have contributed). Conversely, one might want to say that redistribution is when one contributes obligatorily according to their means, and even if one has contributed little, they receive a sufficient pension to live from the age when they are considered too old to work.

Well, actually not at all. We can have a capitalization regime that respects leftist principles.

For example, by making contributions mandatory and not contributing to an individual fund, but a collective one, and by distributing the pensions produced by this fund not based on contributions, but on what is considered to be each person's needs. This is actually how some complementary pension funds created and managed by unions operate today (source:prefon-statuts )

And, conversely, as shown by the pension reform desired by Macron in 2019, making the amount of the pay-as-you-go pension depend exclusively on the amount of contributions paid by the employee (the individualization of rights denounced by the unions) and creating optional ways to contribute (such as buying back points for retirement or the possibility of delaying or advancing one's retirement age in exchange for a modification of their pension).

In fact, the debate over distribution/capitalization is not at all about an ideological question. Both systems can meet the objectives of the right and the left. And once again, contrary to what politicians of all sides say, both systems work just as perfectly as each other.

The difference will therefore not be based on the moral/ideological criteria common to the left or the right. Depending on the context, there are left-wing groups that will prefer capitalization systems and others that will prefer distribution systems.

The real differences between funded pension and pay-as-you-go pension

It is finally time to see what really differentiates these two pension systems, which are:

The implementation deadline

The distribution can be implemented immediately, whereas capitalization will take a generation before paying its first pensions (the time to set aside sufficient savings). Therefore, if we have to immediately manage a mass of elderly people without resources, the distribution system is necessary, at least temporarily.

Capitalization derives its income from all the assets of the planet and not only those of the country where capitalization is established.

Capitalization allows taking money from workers worldwide to finance your country's pensions, while distribution relies only on the assets of your country.

If other countries have strong demographics, it allows solving the problem of the decline in the active/retired ratio of a country without resorting to pension cuts, increases in the retirement age, or immigration (foreign workers are exploited domestically).

The downside is that from now on your retirement depends on a levy on the economy of other countries. A levy that can very quickly be labeled in those countries as neo-colonial plunder to be urgently cut by a populist government seeking savings that has come to power in those countries. And, even if we manage to ensure that these rights will not be questioned, retirement remains dependent on the economy of foreign countries and therefore on their political decisions.

If several countries representing a significant portion of the global economy elect true socialists who genuinely want to challenge the distribution between capital and labor, or nationalists who want to expel foreign multinationals from their territories (think of Trump or the junta in Mali), capital-funded pensions will take a hit. This fosters tensions between countries and a very strong temptation for neocolonial and imperialist policies (or even outright wars).

And frankly, we don't need governments to have more incentive not to respect people's right to decide their own destiny or to commit heinous massacres in our name.

Capitalization increases the price of financial assets

Capitalization increases the price of financial products due to the massive purchases it involves.

If its funds are invested exclusively in domestic stocks, this increases the stock prices and thus allows companies to raise funds more easily and at a lower cost, thereby giving them an advantage over companies in competing countries that have funded pensions.

And, it significantly enriches the wealthiest in the country, as they are the ones who hold the majority of the shares. This therefore leads to an increase in inequalities and the power of billionaires.

On the other hand, if the funds are massively invested in real estate, it makes it more difficult for young people to access property (especially in large cities). You might say that capitalization is not needed for housing in the city to be overpriced, but I would reply that it could be worse.

In France, becoming a homeowner in large cities is expensive, but in the USA, it's actually more than half of the residents who are forced to remain renters (sources:etats-unis-toujours-plus-de-locataires-dans-les-grandes-villes The causes of this phenomenon are not agreed upon, but for me, one of theOne of the major causes is the hoarding of apartments by investment funds intended, among other things, for the retirement of Americans who do not wish to sell and buy at any price. It should be noted, however, that these funds are also fueled by the money of the many millionaires and billionaires in the USA.

Moral: You think equality is expensive, try inequality.

Capitalization can be a geopolitical asset

If the state controls the fund, it can use it as a tool for geopolitical pressure. For example, by threatening to prohibit its fund from investing in an enemy country or, conversely, using it to favor its competitors.

He can also use it to buy strategic foreign companies or those with patents that are interesting for national companies or to eliminate bothersome competition. In short, I'm not going to make a long list of everything one can do to unfairly favor their economy or annoy their neighbor with a large sum of money.

It should be noted, however, that this point is largely theoretical. Indeed, in practice, mixing pension funds with this kind of scheme is taking the risk of losing money and therefore having to announce to citizens that pensions will have to be reduced. Moreover, in general, in order to gain citizens' trust in the fund, it is necessary to make it at least somewhat independent.

And finally, in general, financial companies do not look favorably upon the State meddling in their affairs. Especially when it involves such a large sum of money.

Capitalization gives employees the illusion that their interests are aligned with those of the shareholders.

Capitalization gives employees the impression that they have an interest in a policy favorable to businesses and shareholders.

Basically, it encourages the population to lean more to the right. We see the same phenomenon with owning one's home.

Capitalization gives power and money to finance.

Capitalization changes the power structure in companies and consequently the nature of capitalism.

This barbaric phrase means that in a capitalization system, the sums managed by the pension funds are so enormous that they allow them to become the main shareholders of most large companies (even to the point of taking control) and to be the main sources of financing for companies (and sometimes small states when the fund manages the retirement of countries like the USA).

This gives their manager enormous political and economic power and forces many companies to comply with their demands. And the managers are what we call financiers. The rise of funded pensions in the USA and in many Western countries is one of the reasons why we shifted in the 70s/80s from industrial capitalism to financial capitalism (of course, it is not the only cause).

In addition, managing these considerable amounts of money allows financial companies to earn lucrative commissions, which also contribute to giving them power within society. And also to pay astronomical salaries that will attract the most productive people to finance (like yours truly).

Capitalization can be private and local. And thus managed by direct democracy locally (not the distribution).

Capitalization can be implemented by private actors and at the local level, whereas pay-as-you-go retirement can only be implemented at the national level and by a state. This has advantages and disadvantages.

But the main consequence is that capitalization allows for a retirement system largely managed by the private sector in a competitive market or by local associations managed through direct democracy. This is why the right and part of the left prefer capitalization (but a very different capitalization from that desired by the right).

Indeed, the pay-as-you-go pension system requires a large number of individuals spread over a large territory to function. Otherwise, the risk is too great that a change could make it impossible to pay pensions. For example, if a pay-as-you-go pension system is implemented on the scale of a small town, then over the 30 years during which a retiree will need to receive their pension, there is a high chance that the largest local company might decide to relocate or go bankrupt, leading to an unemployment surge or an exodus of young workers.

As a result, the number of contributors and the amount of contributions may decrease to the point of no longer being able to pay the promised pensions.

On the other hand, with capitalization-based retirement, even if there is a local crisis, the money saved to pay pensions remains always available. This is a positive counterpart that I have not mentioned regarding the fact that capitalization-based retirement allows relying on the income of all the world's assets and not just those of the concerned population. With capitalization-based retirement, for the money to disappear, there must be a crisis severe enough to collapse the national financial system and, in the French case, the global one. Such an event is very unlikely, and if it were to happen, pensions would be the least of our concerns. In such a scenario, it would no longer be possible to buy anything with money anyway.

Capitalization is a much more complex system to manage than distribution.

-

So to higher operating costs. Operating costs are defined as the money that is collected but not used to pay pensions. Finally, that's in the case where we have an efficient and non-corrupt public service (which, whatever one may say, is the case in France).

-

So it requires a certain expertise to be managed or simply understood. This makes capitalization more difficult to manage.Democratically and more sensitive to misinformation and conspiracy theories. But I remind you that at the same time, the distribution is necessarily national and is therefore also very difficult to manage democratically.

-

So the risk of mismanagement is much higher. Indeed, I have argued so far that funded retirement is as safe as pay-as-you-go retirement. However, the most informed will have pointed out to me that weaMany cases in history of the failure of funded pension schemes, while there are almost none for pay-as-you-go pensions (except for Greece in 2012, I don't see any). And this, even though pay-as-you-go pensions are much more widespread.

Example of the failure of funded pension schemes:les-pensions-de-retraite-des-fonctionnaires-americains-sur-la

Capitalization is a potentially more discriminatory system.

We have seen it, insurers decide on the amount of the pension paid based on your life expectancy. However, an insurer could very well decide not to pay the same amount to all populations. For example, to attract clients, an insurer could offer higher pensions to men because they die younger.

Of course, this kind of thing could be prohibited by law, and conversely, one could imagine a distribution system managed by a racist state that would decide that non-French workers would not have the right to the same retirement as whites. But the peculiarity with capitalization insurance is that insurers could be discriminatory while defending themselves from being so. They could already hide the way they do their calculations, but more importantly, they could take shelter behind the market to justify their discriminations and argue that they are not. And thus, it would be harder to fight against.

Let's conclude with my personal opinion

Personally, my perfect system would be 100% distribution because it is a much more elegant and simple system.

There is a need, so a tax is raised to fund it. Capitalization requires going through a complex system that nobody really understands to achieve the same result.

And to address the problem of the decline in the number of active workers, I propose to completely open the borders to immigration and even to pay young people from other countries to come and settle in France.

And in detail, I think that we should all have an identical contribution on all income and a single pension paid to everyone from the same age.

For me, there are no longer retirement ages, but an age from which you receive a pension, whether you continue to work or not.

And everyone has the same retirement. No more stories about the ten best salaries and all that nonsense. Everyone the same, indexed to the average salary.

Equal pay for equal work, and all retirees do the same thing. Paying more taxes should not entitle one to more rights.

Besides, for me, it is the main criterion that should define what should be managed by the state or the private sector. In cases where it is fair to make a distinction between poor and rich, it should be managed by the private sector. On the other hand, if equality between rich and poor is needed, then it should be managed by the state (justice, education, health, etc.).

Thus, the level of pensions will follow that of the working population. There will be no more opposition between the interests of retirees and workers. That way, even if we become as selfish as the boomers, we won't be able to afford to be such xenophobic bastards.

As for people who do hard work, I think that in most cases the solution is not to give them the right to retire earlier, but to make their work less arduous.

It is not normal that at 50 years old most assembly line workers are physically exhausted. After that, there are a minority of cases where it is not possible, like sewer workers or firefighters, and there of course, I agree that they should be given the right to early retirement.

On the other hand, for ballet dancers, I'm sorry, but if it destroys their bodies to the point that they can no longer work from the age of 40, then it is a barbaric practice that must be urgently banned. Or at the very least, deeply reformed to reconcile the continuation of this activity with the preservation of the dancers' health. It is not right to impose on young girls, who are far too young to make their own choices, to sacrifice everything in a competition to see who can best submit their body to inhumane demands solely to satisfy the sadistic desires of a group of privileged people.

But apart from that, I like the broom, I find it very pretty.

Opening on life salary and universal income

Otherwise, I really like Friot's lifelong salary, which I call neo-communism, or the ideas of universal income, both of which involve completely disconnecting the salary one receives from the work one actually does, thus rendering the idea of retirement totally obsolete. Personally, if tomorrow, one of these ideas were proposed, I would sign up immediately, but as it stands, I think I won't see a French society ready to accept this in my lifetime. I might be wrong and I hope I am, but I think the proportion of people who would find it fair or acceptable not to be obliged to work to receive a salary (and conversely that those who work would be obliged to pay taxes/contributions to finance the salary of those who do not work) is too small.

Too bad, because I would really like to know what it would be like. Would the system collapse under the weight of the lazy? Or would everyone work, but produce things for their own pleasure, completely detached?You are.Need for others and society and thus would collapse? Or on the contrary, would the mass of unnecessary, harmful, or simulated work disappear to be replaced by much more useful work, and thus productivity and prosperity would explode?

We will never know. Or rather, I will never know. If you disagree, I invite you to advocate for these ideas by talking about them as much as possible around you, so that one day I will be forced to admit my mistake when I see a prime minister on TV announcing the establishment of a lifelong salary. In the meantime, if we exclude the possibility of decoupling work and salary, I find that my proposal is the fairest and most effective. Or rather, the most effective for achieving what I consider to be fair.